Simple paycheck calculator

See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding. Subtract any deductions and payroll taxes from the gross pay to get net pay.

Paycheck Calculator Take Home Pay Calculator

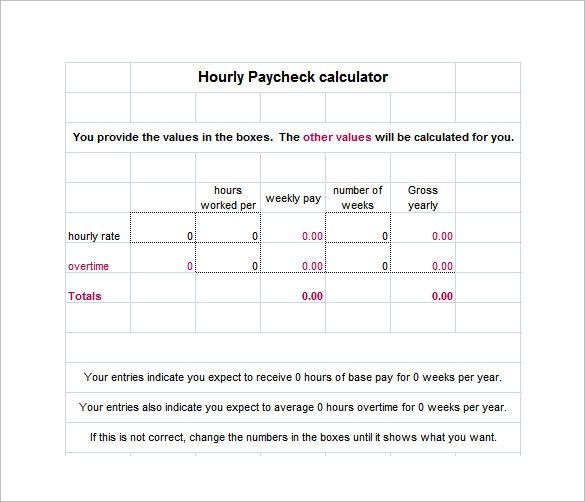

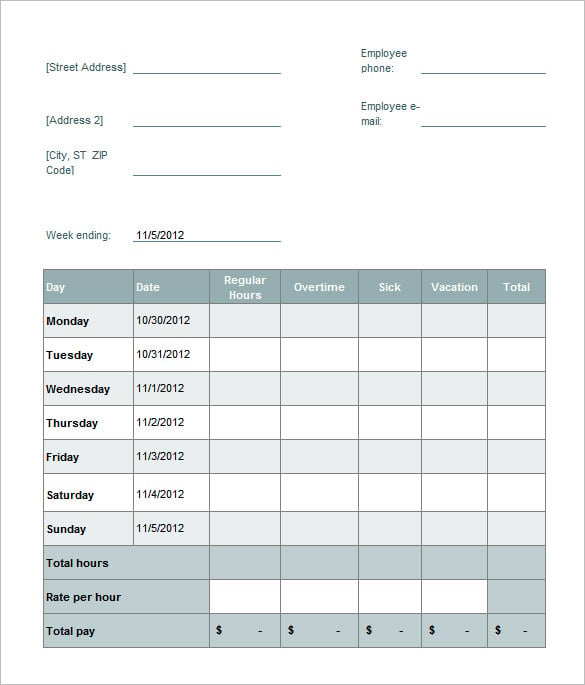

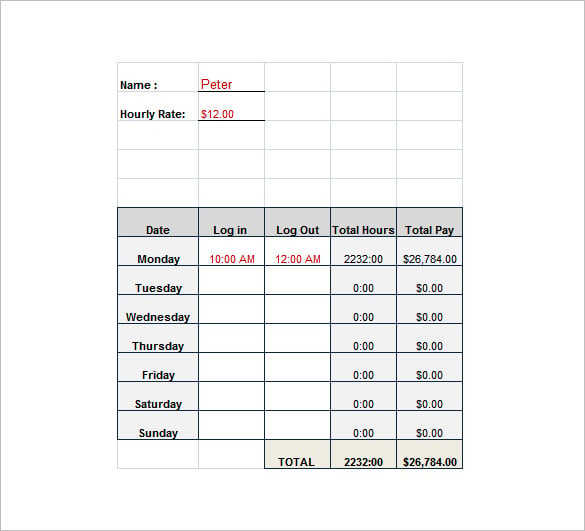

Hourly Paycheck and Payroll Calculator.

. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and. The PaycheckCity salary calculator will do the calculating for you. Number of Qualifying Children under Age 17 Number of Allowances State W4 Pre-tax Deductions 401k IRA etc Check Date MMDDYYYY Next.

Paycheck Manager offers both a Free Payroll Calculator and full featured Paycheck Manager for your Online Payroll Preparation and Processing needs. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. Salary Paycheck and Payroll Calculator.

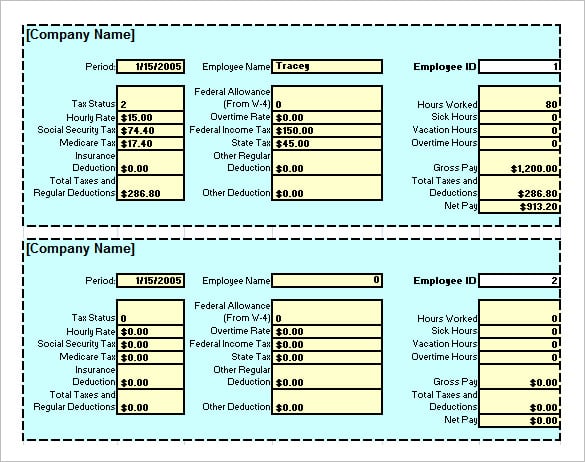

Your marital status determines which formula your employer will use to calculate the tax to be withheld from your paycheckThis is because the tax rates and standard deduction amounts are different depending on whether you are married or single. Our free salary paycheck calculator see below can help you and your employees estimate their paycheck ahead of time. Dont want to calculate this by hand.

There is no head of household status for withholding formulas. If youd like to know how to estimate compound interest see the article. Calculating paychecks and need some help.

Small Business Low-Priced Payroll Service. Enter the required information into the form to instantly get your results. Its a simple four-step process.

Withhold all applicable local state and. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. This number is the gross pay per pay period.

Need help calculating paychecks. 3 Months Free Trial. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees. Total Earning Salary. Fast and basic estimates of Fed State Social Security Medicare taxes etc.

State Pay Cycle. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Determine your taxable income by deducting pre-tax contributions.

Switch to California hourly calculator.

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Free Paycheck Calculator Salary Pay Check Calculator In Usa

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Paycheck Calculator Take Home Pay Calculator

Free 12 Paycheck Calculator Samples Templates In Excel Pdf

Paycheck Calculator For Excel Paycheck Payroll Taxes Consumer Math

Payroll Calculator Excel Template 2022 Paycheck Spreadsheet

Payroll Calculator Free Employee Payroll Template For Excel

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Top 6 Free Payroll Calculators Free Paycheck Calculator App Timecamp

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates

Free Online Paycheck Calculator Calculate Take Home Pay 2022

8 Salary Paycheck Calculator Doc Excel Pdf Free Premium Templates